.webp)

The U.S. accounting sector is under intense pressure. Rising operational costs, stricter deadlines, and a shrinking workforce are compelling firms to reassess their approach to managing core functions. Today, approximately 1.78 million accountants are working in the United States, a 10% decrease from 2019, and nearly 75% of CPAs are approaching retirement age. With fewer graduates choosing accounting as a career and many professionals leaving the field, firms are struggling to fill roles and meet client expectations.

That's why many practices are turning to foreign markets, with India emerging as the top destination for outsourcing. By tapping into a large base of English-speaking and globally trained professionals, CPA firms outsourcing to India can manage everything from bookkeeping and payroll to complex audit support and tax compliance.

This isn't simply about cheaper labor. It's about building resilience, accessing specialized expertise, and scaling capacity without the risks of constant hiring. In this blog, you'll see why U.S. firms are increasingly choosing India for accounting outsourcing, what specific tasks you can delegate, and how this approach helps maintain profitability and compliance.

The U.S. accounting workforce is shrinking at a time when demand is growing. Several factors are driving this waning interest. A key issue is the 150-credit hour requirement (effectively a fifth year of education) needed for CPA licensure, which many prospective accountants see as a costly hurdle given the returns.

Add to this the long hours, lower pay compared to other finance roles, and the perception that accounting is less attractive than tech or investment careers, and the pipeline of new CPAs has slowed dramatically.

It's not just smaller practices feeling the strain. Top brands have expanded operations in India to meet staffing needs. The Big Four employ between 140,000 and 160,000 professionals in their global capability centers in India, making offshore support a standard practice rather than an exception.

.webp)

This talent crunch has created ripple effects across industries, including:

Why it matters: A U.S. CPA firm entering peak audit season risks missing deadlines and reputational damage without additional support. Meanwhile, a mid-sized retailer relying on accurate reconciliations for vendor payments could face operational slowdowns if staff can't keep up.

Faced with rising costs and a shrinking talent pool, many U.S. firms are seeking reliable, affordable accounting support that meets global standards. More often than not, the answer is India.

Outsourcing accounting tasks to India has moved from being a cost-cutting tactic to a strategic decision for many U.S. firms. Whether you're a CPA practice tackling seasonal audit spikes or a mid-sized company struggling with payroll and reconciliations, India offers a combination of cost savings, skilled professionals, and scalability that's hard to replicate locally.

The primary reason behind the relocation of several accounting-related tasks by U.S. accounting firms to India is the substantial cost advantage. Labor costs are significantly lower compared to hiring in the U.S., making it an attractive option.

Here's how the numbers typically compare:

Source: Indeed

But the savings don't stop at salaries. It removes several hidden overheads that often go unnoticed when firms calculate their actual costs:

These savings enable CPA firms to reallocate capital into client-facing services, helping mid-sized companies scale without compromising compliance. For example, a retail company can avoid payroll delays during expansion by outsourcing AP/AR processes instead of building a new department internally.

Return on Investment Calculations

When evaluating the cost of outsourcing, you should consider the total return on investment, which extends beyond simple cost comparison:

India produces nearly 250,000 accounting graduates annually, with many trained for the global market. Alongside this, the country has Chartered Accountants (CAs) and thousands of professionals with global credentials, such as U.S. CPAs.

These professionals aren't limited to bookkeeping. They handle complex tasks, including statutory audit documentation, tax preparation, and financial analysis. Outsourcing firms also ensure that their teams receive continuous updates on international standards, such as U.S. GAAP and IFRS.

Struggling to find qualified accountants who can deliver compliance-ready reports on time? VJM Global provides U.S.-trained offshore teams to support your firm's growing needs.

Leading Indian partners operate with technology infrastructures that equal or surpass many small and mid-sized U.S. practices. Cloud platforms ensure real-time collaboration, and teams are fluent in tools.

Security standards are another differentiator. Many firms hold:

This gives U.S. firms confidence that financial data is protected at a level comparable to, or exceeding, what they could maintain internally.

Accounting workloads are rarely steady. Tax season can overwhelm staff, while quieter months create inefficiencies. Outsourcing to India enables you to scale support up or down as needed, without the delays and risks associated with local recruitment. For instance:

This flexibility ensures you don't have to compromise on service delivery, even during periods of growth or transition.

The U.S.-India time difference creates a near 24/7 productivity. Work assigned at the end of a U.S. business day is often completed by the time teams log in the next morning. For CPA firms, this enables faster turnaround on client deliverables during peak season.

Outsourcing routine accounting frees up your senior staff for higher-value work. Partners and managers can shift their focus away from reconciliations or AP/AR oversight to concentrate instead on advisory services, tax strategy, or financial consulting.

This reallocation improves profitability and deepens client relationships. It also makes firms more competitive, as clients increasingly seek strategic insights in addition to compliance services.

Pro Tip: Track how much of your staff's time is spent on low-value tasks. If it's more than 30%, outsourcing can be a great alternative to improve ROI.

India offers one of the largest English-speaking professional workforces, and business etiquette aligns closely with U.S. expectations. Many have a strong track record working with US-based businesses, from startups to CPA firms. This reduces miscommunication and ensures smoother collaboration.

Trust is critical while deploying financial work. Indian firms strengthen confidence by signing confidentiality agreements, adhering to strict compliance protocols, and undergoing regular security audits.

This is why major U.S. and global firms have invested heavily in India's outsourcing ecosystem. For smaller CPA firms and businesses, this translates into access to the same secure infrastructure and trained talent at a fraction of the cost.

Also Read: Outsourcing Accounting Services for the USA: Why It's the Best Decision You Can Make

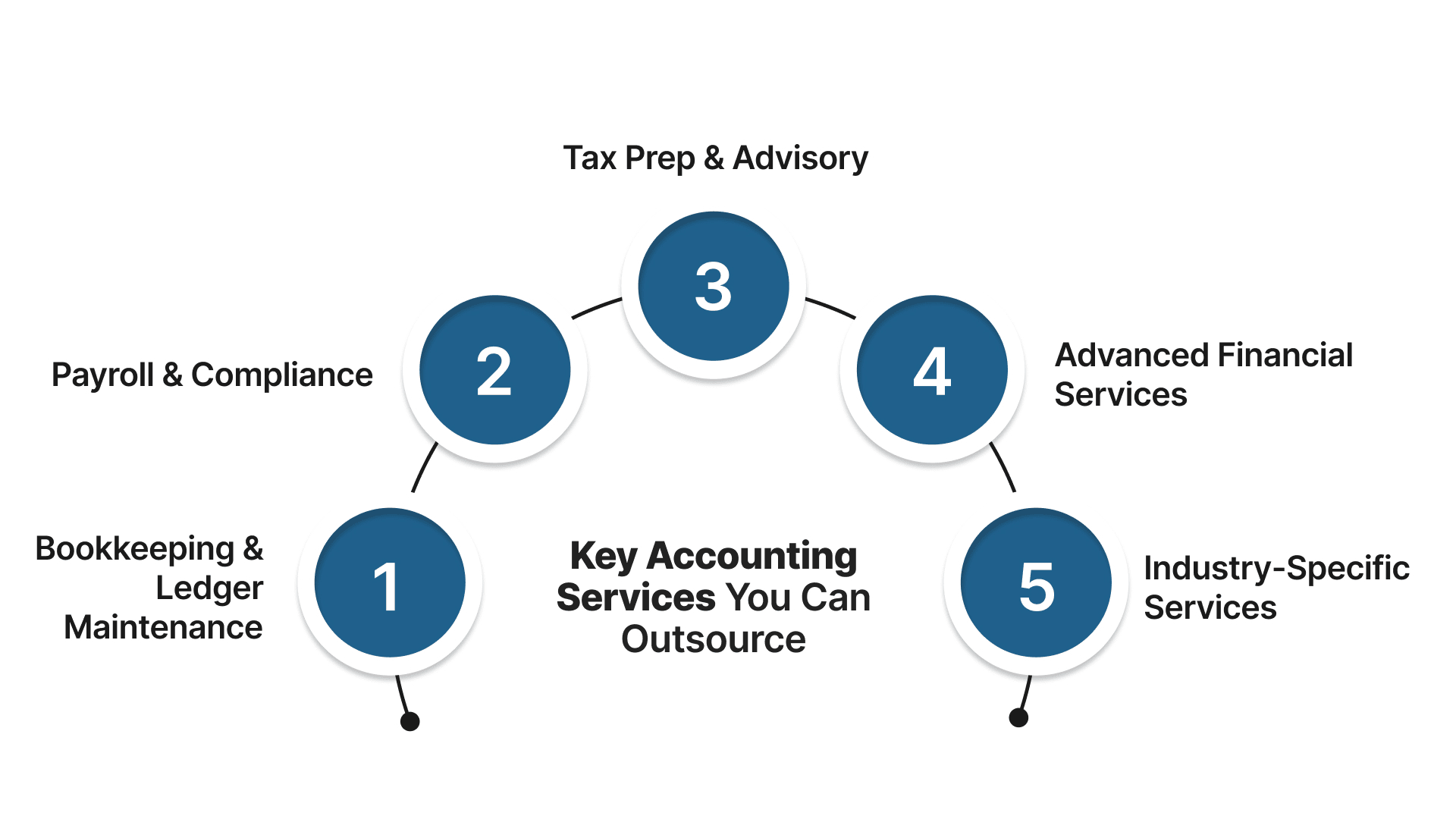

While the benefits are compelling, many businesses want to know what this really looks like in practice. The range of services that can be outsourced helps explain why startups and CPA firms now rely on Indian providers.

Clarity on what exactly can be outsourced helps you decide which functions to offload and which to keep in-house. These services aren't "one size fits all." Instead, Indian firms offer flexible models, ranging from transactional bookkeeping to more comprehensive financial planning. With the growing presence of U.S. accounting in India, companies can confidently select services that fit their size, sector, and growth stage.

At the foundation is day-to-day bookkeeping. This ensures the accurate recording and organization of every financial transaction, keeping your clients' books audit-ready and compliant. Every day, outsourced tasks include:

Payroll isn't just about paying employees; it also involves regulatory filings and accuracy checks to ensure compliance with relevant laws and regulations. Offshore teams handle:

Also Read: Top Benefits of Outsourcing Bookkeeping and Payroll

Indian partners support both compliance and planning. Their services extend across:

For firms needing more than compliance, outsourcing can also cover higher-level financial management:

Beyond general accounting, Indian firms also provide tailored services for specific industries:

Identifying the right services is only half the equation. The real impact comes from how you set up and manage the process from the very beginning.

Jumping into outsourcing without a proper plan can create more issues than it solves. A structured approach ensures U.S. CPA firms and mid-sized companies can transition smoothly, protect compliance, and build long-term value. In fact, successful accounting outsourcing to India by CPA firms often starts with a clear roadmap that minimizes risks and maximizes efficiency.

1. Identify Your Priorities: Begin by defining which accounting processes are best suited for outsourcing. CPA firms outsourcing to India often begin with audit preparation, reconciliations, or tax season overflow, while mid-sized businesses typically outsource bookkeeping, payroll, or vendor management. Clarity on your objectives helps you select the suitable partner and prevents scope creep later.

2. Shortlist and Evaluate Providers: This is the most critical step. Look for firms with:

Example: A U.S. CPA firm serving non-profits should prioritize providers with a track record in grant accounting and fund reporting, not just general bookkeeping.

3. Compare Proposals Before Signing: Request competitive bids and review them carefully. Look for details on:

This step ensures you aren't just chasing the lowest cost, but the best overall fit.

4. Prioritize Data Security: Accounting data is highly sensitive, so security checks are non-negotiable. Confirm that your partner:

Example: A CPA firm outsourcing tax prep must verify that draft 1040s and 1120s are stored on secure servers accessible only by authorized staff.

5. Start Small With a Pilot: Before handing over your entire finance function, run a pilot project. This could be a one-month payroll cycle for a mid-sized company or a set of audit work papers for a CPA firm. Use this phase to evaluate communication, accuracy, and responsiveness. A well-executed pilot builds trust and exposes gaps that can be corrected before scaling.

6. Establish Clear KPIs and SLAs: Formalize the relationship with measurable benchmarks. Define:

Example: A CPA firm may establish a standard that draft audit files must be delivered within five business days, with a margin of error of less than 2%.

7. Integrate Systems and Workflows: A smooth workflow is crucial for efficiency. Ensure your offshore team integrates directly with your existing systems to eliminate duplication and reporting lag.

8. Onboard and Communicate Regularly: Once the partnership is live, invest in thorough onboarding. Walk your offshore team through your goals, workflows, and KPIs. From there, establish a series of review calls, monthly reports, and quarterly check-ins to keep everything aligned.

Example: A mid-sized SaaS company might schedule weekly calls for reconciliations, while a CPA firm may prefer daily updates during tax season.

9. Optimize and Scale Over Time: Start with core functions, then expand gradually. Provide regular feedback and track performance against KPIs. As trust builds, you can move from transactional work to higher-value services such as financial analysis, cash flow forecasting, or controller-level oversight.

Example: A CPA firm that begins with audit prep may later add tax advisory support. A retailer may scale from AP/AR processing to complete month-end closing.

Also Read: In-House vs Outsourced Accounting: Pros and Cons Analysis

Getting the steps right is necessary, but the real difference comes from who you choose to work with. A dependable partner ensures these practices translate into real results for your firm's tangible clients.

Outsourcing in 2025 extends beyond cost-cutting. It's about creating a finance function that's reliable, scalable, and built for today's demands. VJM Global collaborates with U.S. CPA firms and mid-sized businesses to address real operational challenges, while enhancing compliance and financial control.

Struggling to keep up with tax season deadlines or audit prep? VJM Global provides your firm with the offshore capacity to handle seasonal spikes without compromising accuracy or compliance. Schedule a consultation to get started.

Most providers can begin services within 2-4 weeks after the contract is signed. The timeline includes team assignment, system setup, and initial training. Pilot projects can often start within 1-2 weeks.

This depends on your disclosure preferences. Many U.S. firms include outsourcing arrangements in their engagement letters. Studies show that transparency about outsourcing rarely creates client concerns when quality standards are maintained.

Yes, we have dedicated teams for healthcare, real estate, manufacturing, and e-commerce, with expertise in industry-specific GAAP requirements, compliance standards, and tailored reporting to meet the unique needs of each sector.

While outsourcing is valuable for transactional and compliance tasks, functions that require direct client interaction or strategic judgment, such as cash flow decisions, financial advising, or high-level planning, are best managed internally.