India offers fertile ground for innovation and expansion in the software industry. For US entrepreneurs eyeing international growth, registering a software company in India presents a practical and strategic opportunity. With its deep talent pool, cost-effective operations, and strong digital infrastructure, India remains one of the most attractive destinations for global tech businesses.

According to NASSCOM’s 2024 report, India’s technology industry reached $254 billion in revenue, with software exports accounting for over 50 percent of that value. The country is also home to more than 30,000 tech startups, making it the third-largest startup ecosystem globally.

In this article, you’ll learn what defines a software company, why India is a smart choice for starting one, and how to register it legally and efficiently. Whether you’re launching a fresh venture or expanding an existing one, this guide will walk you through the process of registering an IT company in India with clarity and confidence.

A software company is a business entity primarily focused on designing, developing, distributing, and supporting software products or services. Unlike companies that produce physical goods, software companies create intangible digital solutions that help individuals, businesses, and organizations automate tasks, solve problems, and improve efficiency.

Software companies can specialize in various types of software, including but not limited to:

These companies may operate on different business models, such as selling software licenses, offering subscription-based software-as-a-service (SaaS), providing custom software development, or delivering cloud-based solutions.

In addition to software creation, many software companies also provide ongoing support, updates, and maintenance to ensure their products continue to meet user needs and adapt to evolving technology standards.

Now, let's discuss the various types of software companies that exist.

Also Read: How to Register a Holding Company in India

Software companies fall into several categories, depending on their business model, product type, and service offerings:

Choosing the right type depends on your long-term goals, technical expertise, and market approach.

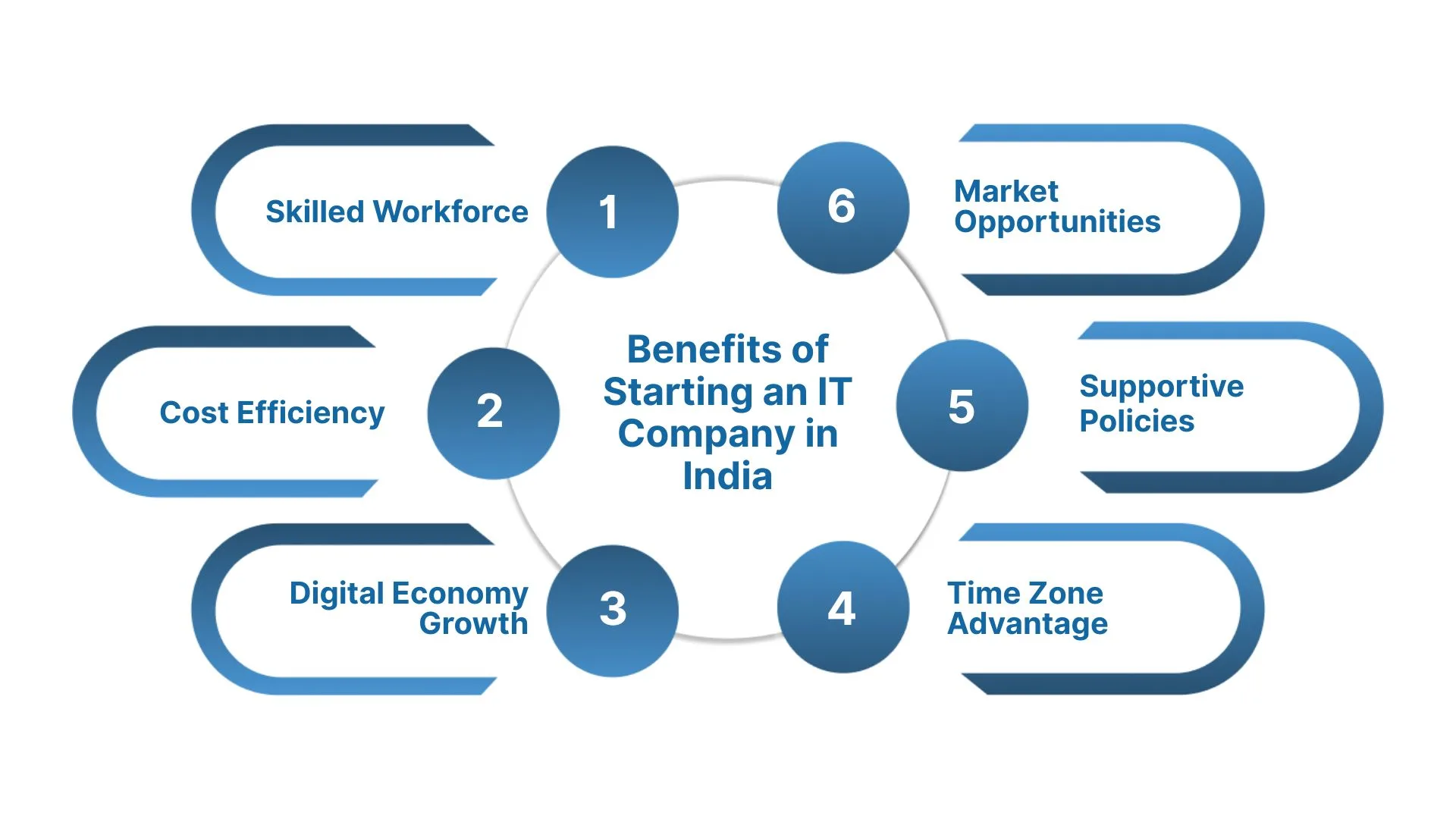

So, why should you register an IT company in India? Let us look at the advantages that it serves.

India stands out as a strategic location for IT ventures, especially for US businesses and entrepreneurs looking to expand globally. Understanding the importance and potential of this market is key before you register an IT company in India.

Why Register an IT Company in India?

Registering your IT company in India is not just about setting up a business entity; it’s about positioning yourself at the heart of a booming tech ecosystem with access to global talent and new markets. Whether your goal is to build a development center, provide IT services, or create innovative products, India offers a platform to grow fast and cost-efficiently.

Now, let us walk you through the detailed process of registering a software company in India.

Suggested Read: How to Close a Registered Company in India: Step-by-Step Guide

India has rapidly emerged as a global hub for software development, IT services, and tech innovation. For US entrepreneurs, registering a company in India opens access to a skilled talent pool, favorable cost structures, and a thriving business ecosystem. However, the registration process involves navigating through various legal, tax, and regulatory steps.

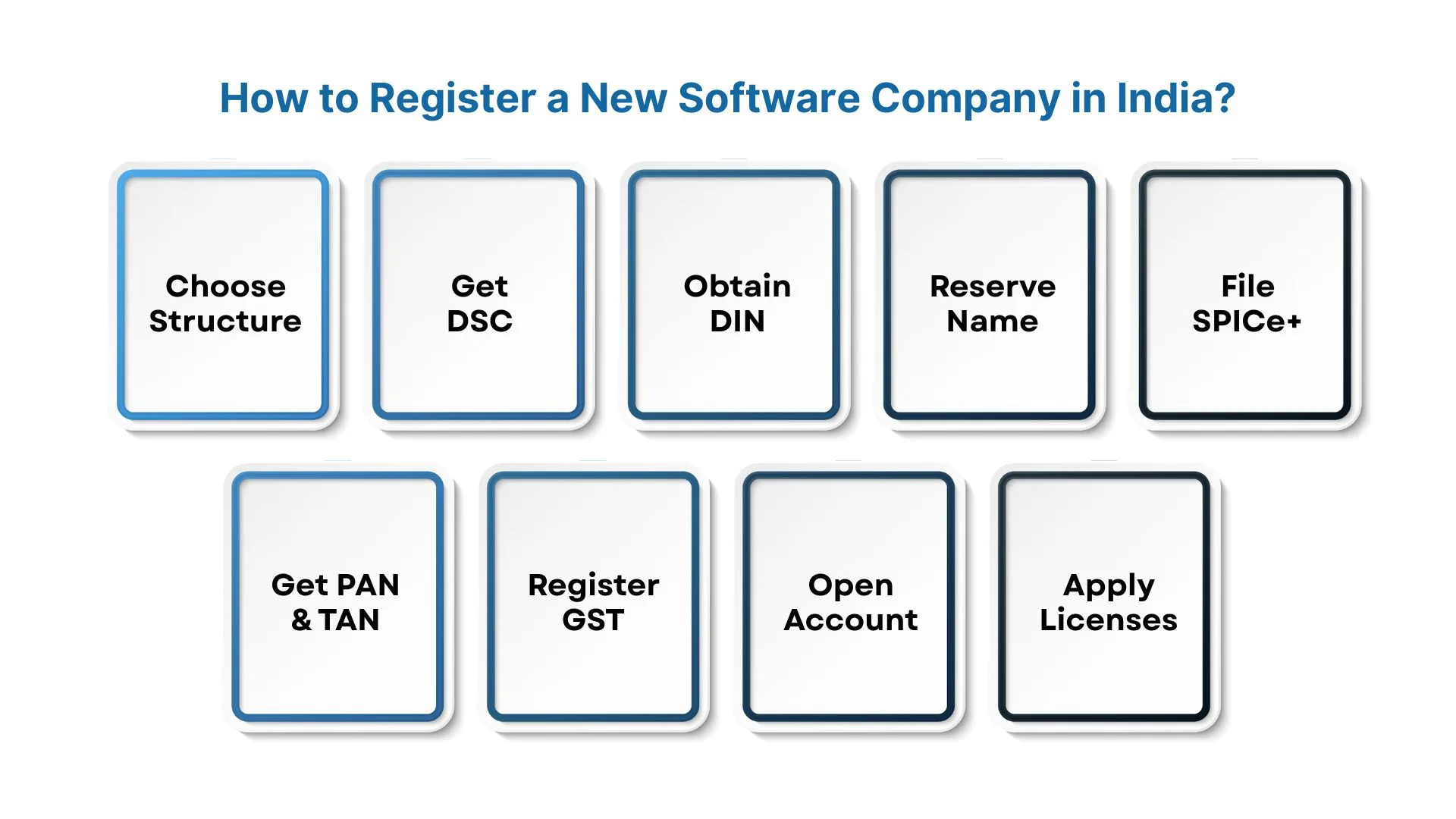

Here’s a detailed, tip-driven guide to help you smoothly register an IT company in India.

Your company’s legal structure will determine its tax treatment, compliance requirements, and how you manage ownership. India offers several types of entities, each suited to different business goals. The most common structures for foreign-owned tech firms include:

Tip: Most US-based entrepreneurs opt for a Private Limited Company due to its limited liability protection, ease of capital raising, and global acceptance.

Since all filings for company incorporation are done online through the MCA (Ministry of Corporate Affairs) portal, a Digital Signature Certificate (DSC) is mandatory for every proposed director. This digital key authenticates the director’s identity and authorizes online documents.

Tip: Start this process early. Many foreign applicants face delays due to verification issues; therefore, it is recommended to apply with accurate passport and address details through a certified provider, such as eMudhra or Sify.

A Director Identification Number (DIN) is a unique ID issued to each director of a company in India. It guarantees the government can track a person’s involvement in multiple companies and hold them accountable for compliance.

Tip: When filing through the SPICe+ form, DINs for up to three directors can be generated instantly. There’s no need for a separate DIN application if you're incorporating the company directly.

Your company name must align with MCA naming guidelines and clearly reflect your business. You’ll need to apply for name approval through the RUN (Reserve Unique Name) facility before incorporation.

Tip: Conduct a preliminary name availability check on the MCA portal. Avoid generic names, and include industry-specific words like “Technologies,” “Software,” or “Solutions” for faster approval.

SPICe+ is an integrated online form that streamlines the incorporation process. It includes company registration, PAN and TAN allotment, GST registration, and other services. You’ll need to submit key documents such as:

Tip: Engage a local company secretary or incorporation expert to help draft the MoA and AoA. These documents should accurately reflect your company’s tech focus and future goals.

The Permanent Account Number (PAN) is crucial for filing income tax returns in India. At the same time, the Tax Deduction Account Number (TAN) is required to withhold taxes from payments such as salaries or vendor invoices.

Tip: You don’t need to apply separately for these numbers if you use the SPICe+ form. They’re automatically processed with incorporation. Just double-check that your form details are accurate.

If your IT company offers taxable services or exports software, Goods and Services Tax (GST) registration is mandatory. GST is a federal tax applicable across India and is required for invoicing and compliance purposes.

Tip: Even if your revenue is from international clients, registering for GST allows you to claim input tax credits and qualify for zero-rated export status.

Once your company is registered and you’ve received the PAN and incorporation certificate, the next step is to open a current account with a reputable Indian bank for all business transactions.

Tip: Choose a bank with strong online banking and international transfer support; ICICI, HDFC, Axis, or SBI are popular among foreign businesses. Some banks even offer business startup packages with dedicated advisors to support their clients.

Depending on your office location and business model, you might need licenses like:

Tip: Consult a local chartered accountant or business advisor to identify state-specific requirements and avoid compliance gaps early on.

So, what are the legal requirements that countries must fulfill when registering a software company in India? Let us understand below.

Once the company is registered, it must remain compliant with India’s ongoing legal and regulatory framework to avoid penalties and maintain a good standing.

1. ROC Filings: All companies registered under the Companies Act must file annual returns and audited financial statements with the Registrar of Companies (ROC). This includes forms like AOC-4 and MGT-7. Non-compliance can lead to late fees or the disqualification of directors.

2. Income Tax Compliance: Companies must file income tax returns annually and pay advance tax if applicable. For software companies operating as a subsidiary of a US entity, transfer pricing regulations apply. This requires maintaining documentation to justify transactions with the US parent and filing Form 3CEB if applicable.

3. GST Registration and Filings: Software and IT services are typically subject to 18% GST. Businesses must register for GST, issue proper invoices, and file monthly or quarterly returns (GSTR-1 and GSTR-3B) depending on turnover. The export of software services may be zero-rated, but it must be supported by appropriate documentation under the LUT (Letter of Undertaking) scheme.

4. Employment and Labor Law Compliance: Hiring employees in India requires compliance with local labor laws. This includes issuing formal employment contracts, contributing to the Provident Fund (EPF) and Employee State Insurance (ESI) where applicable, and adhering to regulations on gratuity, leave policies, and termination procedures. Companies must also follow the Shops and Establishments Act of the respective state.

5. Data Protection and Cyber Laws: If your business collects, stores, or processes user data, you must comply with India’s Information Technology (IT) Act and its rules. With the Digital Personal Data Protection Act (DPDPA) expected to be enforced soon, companies should proactively adopt data governance measures such as clear consent mechanisms, user data audits, and cross-border data transfer protocols to align with the upcoming legal framework.

6. Other Licenses and Local Registrations: Depending on your office location, you may need trade licenses, professional tax registrations, or registrations under local municipal laws. These are usually state-specific and often overlooked by foreign founders.

So, what are the challenges associated with setting up a software company in India? Let us discuss them in more detail below.

You Might Also Like: Guide to Registering a Sole Proprietorship in India

Registering a company is just the first step. For US entrepreneurs running a software firm in India, day-to-day operations can be complex, particularly when navigating local compliance, tax regulations, and talent management.

The technology sector advances at a breakneck pace in software. New programming languages, frameworks, tools, and platforms emerge regularly, requiring constant learning and adaptation. Companies struggle to keep their teams updated, which can lead to outdated skills, reduced productivity, or missed market opportunities.

The barrier to entry in software development is relatively low, leading to a crowded marketplace. Startups and established firms alike face intense competition, making differentiation and innovation critical. Without a unique value proposition, products risk being lost among numerous alternatives.

Software systems are prime targets for cyberattacks, including malware, ransomware, and data breaches. Protecting user data and maintaining secure applications requires continuous investment in security practices and compliance with evolving regulations like GDPR and CCPA. Failure to do so can result in costly legal penalties and a damaged reputation.

Software projects often face challenges in scope definition, time estimation, and resource allocation. Poor planning can lead to delays, cost overruns, and unsatisfactory deliverables. Managing cross-functional teams, especially in remote or distributed environments, adds another layer of complexity.

The demand for skilled software engineers, UX designers, and other technical professionals outpaces the supply. Recruiting and retaining top talent remains a significant challenge due to competitive salaries, company culture, and career development opportunities. High turnover disrupts continuity and inflates hiring costs.

Delivering high-quality software requires rigorous testing and bug tracking. However, tight deadlines often force teams to cut corners, leading to software defects that affect user experience and increase maintenance costs. Balancing speed and quality remains a persistent challenge.

As software increasingly touches regulated industries such as healthcare, finance, and telecommunications, companies must comply with specific standards and laws. Non-compliance can result in severe financial penalties and operational restrictions.

Protecting proprietary code, algorithms, and software designs from infringement or theft is critical. The global nature of software distribution complicates IP enforcement, exposing companies to risks of piracy and unauthorized use.

End-users expect smooth, intuitive, and constantly improving software products. Keeping pace with these expectations while managing costs and timelines requires agile development and strong customer feedback mechanisms.

Startups and small companies often rely on venture capital and external funding, which can fluctuate with economic cycles. Budget constraints may limit R&D, marketing, and scaling efforts, jeopardizing growth plans.

Now that we know everything about setting up a software company in India, let's explore how VJM Global helps diverse businesses establish their operations here.

Starting a software company in India requires more than just a great idea. It demands legal clarity, regulatory compliance, and precise execution. From choosing the right business structure to navigating tax registrations and foreign investment regulations, every step must be handled with care.

A well-structured incorporation process sets the foundation for long-term success. Entrepreneurs who get this right early on gain operational clarity, compliance confidence, and a faster route to funding and scalability.

Take control of your business setup journey today. VJM Global offers tailored company registration solutions that empower software entrepreneurs, both domestic and foreign, to launch in India with ease and confidence:

With evolving regulations and growing demand for digital services, more tech founders are turning to VJM Global to register their software companies in India quickly, compliantly, and affordably.

Ready to launch your tech startup in India? Partner with VJM Global and lay the right foundation for your business. Contact us today to get started.

Ans. You need to decide the company structure (Private Limited, LLP, or Sole Proprietorship), obtain Digital Signature Certificates (DSC), Director Identification Number (DIN), and file incorporation forms with the Ministry of Corporate Affairs (MCA). Additionally, registering for GST and other applicable licenses might be necessary.

Ans. Typically, it takes between 7 to 15 working days to complete the registration process, depending on document readiness and government approvals.

Ans. Key documents include identity and address proofs of directors and shareholders (such as Aadhaar or passport), proof of registered office address, NOC from the property owner, and the company’s proposed name and business details.

Ans. Yes, NRIs and foreigners can register a software company in India, subject to compliance with the Foreign Direct Investment (FDI) policy and relevant RBI regulations.