Expanding into India is a smart move, but the registration process can feel overwhelming, especially if you’re unfamiliar with the local regulations. In 2024, India saw over 185,000 new companies register, a 16% jump from the year before. This surge is proof that businesses, both local and international, are flocking to India for its growth potential.

For U.S. entrepreneurs, registering a company in India can provide a world of opportunities, but it’s important to know what you’re getting into.

This blog will break down why registering a company in India makes sense, from tax benefits to access to a massive consumer base. By the end, you’ll see how India can be the next big move for your business, setting you up for long-term success. Let’s jump in.

Company registration in India is the formal process of legally establishing your business as an independent entity under Indian law. This involves selecting a business structure, such as a Private Limited Company or LLP, and filing the necessary documentation with India’s Ministry of Corporate Affairs.

Once registered, your company is recognized as a legal entity, distinct from its owners.

Also Read: Documents Needed For Company Registration In India From The US

Now that we’ve covered what company registration entails, let’s explore the key advantages of registering your business in India.

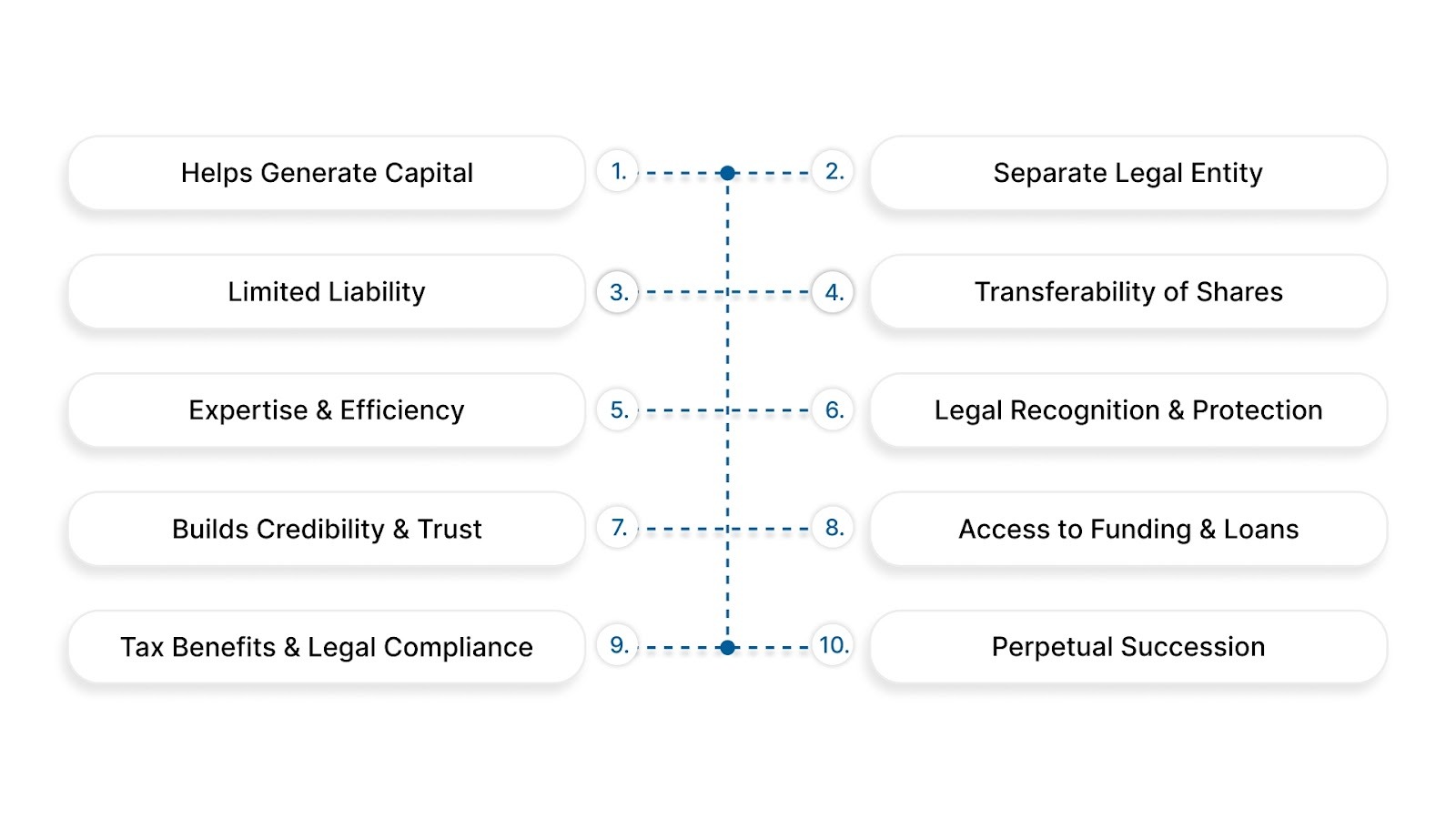

Registering a business in India opens up numerous benefits for U.S. entrepreneurs. Let’s take a look at how it can help your company grow and thrive:

When you register a company in India, it becomes much easier to raise capital. This can be through equity (raising funds via the public) or debt (bank loans or credit). A registered company is considered more reliable, which increases its chances of obtaining capital.

One of the core advantages of registering a company is that it becomes a separate legal entity. This means the company can buy, sell, and own property in its name, sue, and be sued independently of its owners.

For foreign companies expanding to India, this provides protection for personal assets. The introduction of the One Person Company (OPC) under the Companies Act 2013 even allows a solo entrepreneur to enjoy limited liability.

Incorporation ensures limited liability for the company’s owners. If your company faces financial difficulties, the liability is capped at the amount unpaid on the shares you own, not extending to your personal assets.

For instance, if you own shares in a company worth ₹100 each, your liability is limited to that amount, making it a far safer option than a sole proprietorship or partnership.

When a company is incorporated, its shares can be easily transferred from one person to another, allowing shareholders to liquidate or bring in new investors. This makes it easier for entrepreneurs to raise capital if needed.

The separation between ownership and management allows businesses to hire experts in various roles, improving the company’s efficiency and accountability.

This enables the business to attract top talent, as the availability of resources often leads to better salary packages. For example, a U.S. tech company entering India can hire local industry experts to lead operations while retaining control over overall strategy.

A registered company becomes a separate legal entity, capable of owning assets, entering into contracts, and taking on liabilities in its own name. This protects personal assets from any business-related legal issues or debts.

This is especially crucial for businesses entering a new market like India, where legal clarity and protection are essential to avoid any disputes.

A legally registered company in India builds credibility, which is crucial when working with investors, clients, and suppliers. It demonstrates professionalism and commitment to long-term growth, making it easier to secure business partnerships and investor interest.

Registering a company in India opens the doors to loans, venture capital, and financial schemes. Banks and investors prefer working with registered companies because the legal framework ensures transparency and accountability.

U.S. companies can access Indian government schemes or private investor funds that are otherwise unavailable to unregistered businesses.

Registration allows access to tax benefits under the Income Tax Act, including deductions and exemptions that aren’t available to unregistered businesses. Additionally, being registered ensures compliance with tax obligations, such as GST and income tax filings, helping to avoid penalties.

This significantly reduces operational costs and simplifies U.S. business operations in India.

A registered company enjoys perpetual succession, meaning it continues to exist even if shareholders or directors change. This offers stability and security for long-term business planning. Foreign entrepreneurs can rest assured that their business in India will not be disrupted by personal changes in ownership or leadership.

Also Read: Company Registration Cost in India Explained

Registering your business ensures long-term stability, ease of expansion, and a solid foundation for success in the Indian market. At VJM Global, we guide U.S. entrepreneurs through every step of the registration process, ensuring compliance and helping you set up for expansion. Get expert advice today.

With these advantages in mind, let’s take a closer look at the specific benefits of registering a Private Limited Company in India.

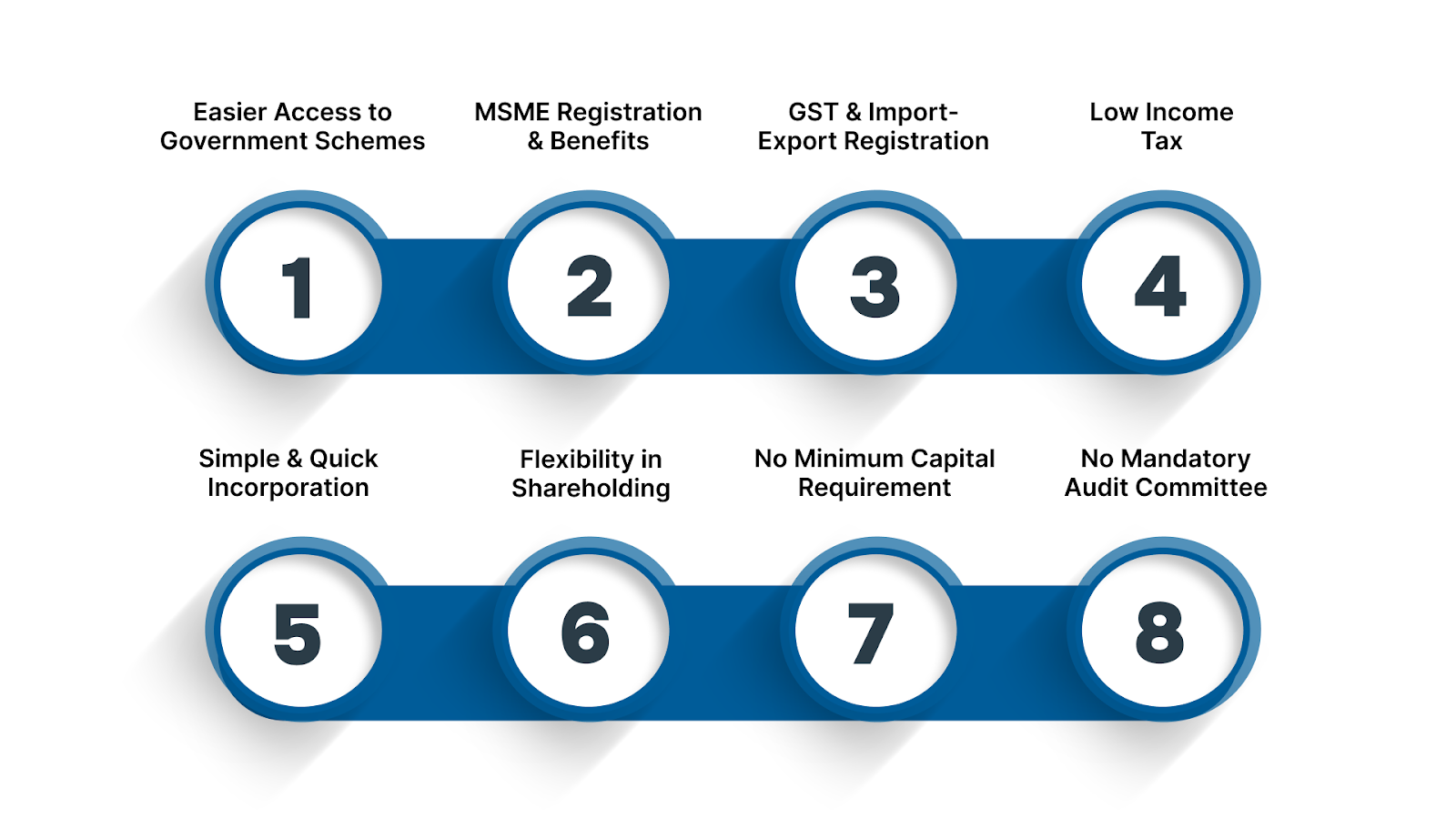

Private Limited Companies (Pvt Ltd) are the most common choice for U.S. entrepreneurs looking to expand into India. Here's why:

Registering a Private Limited Company in India opens doors to government programs designed to support businesses, including financial incentives, subsidies, and tax breaks. For U.S. businesses, this makes the entry process much smoother, providing easier access to funding and growth support.

By registering as a Private Limited Company, you can also apply for MSME (Micro, Small, and Medium Enterprises) status, which offers benefits such as low-interest loans and improved market access.

A Pvt Ltd company can easily register for GST (Goods and Services Tax), simplifying your tax filings. Additionally, having an Import-Export Code (IEC) opens the door to expanding internationally, an essential step for global business operations.

Under Section 80IAC of the Income Tax Act, startups registered as Pvt Ltd companies benefit from tax holidays for the first few years. This significantly reduces your tax burden during the early stages of business operations.

The introduction of the SPICe+ (Simplified Proforma for Incorporating Company Electronically) application has streamlined the company registration process in India. The entire process is online, reducing paperwork, time, and cost, making it hassle-free for U.S. entrepreneurs.

Private Limited Companies in India require only two shareholders to get started, with a maximum of 200 shareholders. This flexibility makes capital raising easier during your company’s growth phase compared to other structures with more rigid requirements.

Previously, a minimum capital of ₹1 lakh was required to register a Pvt Ltd company. Now, businesses can register with a zero minimum capital requirement, helping entrepreneurs start operations without a large upfront investment.

Also Read: How to Start a Business with Limited Funds in 2025

Unlike public companies, Private Limited Companies don’t need to establish an audit committee, which can be both costly and time-consuming. This exemption reduces the complexity and compliance costs for expanding businesses.

With all the advantages it provides, a Pvt Ltd company is a viable option for those serious about long-term growth in India.

Also Read: Why Should You Register A Private Limited Company?

Next, let’s understand how VJM Global can guide you through the company registration process and help your business succeed in India.

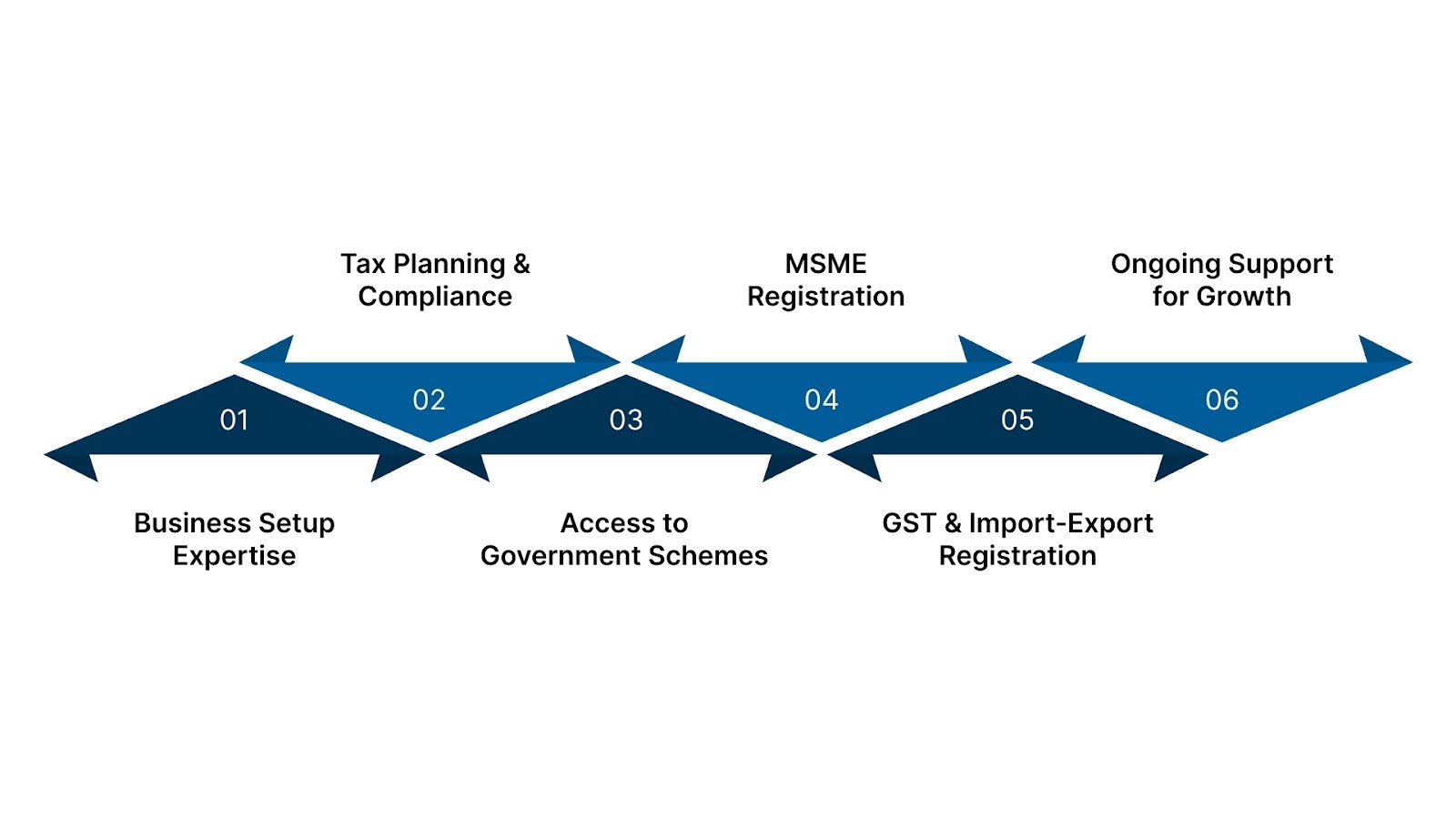

Registering a company in India is a strategic move, and VJM Global is here to guide you through every step of the process. Here’s how we can help:

Let VJM Global simplify your company registration process in India and help you experience the full potential of this dynamic market.

Registering a company in India opens up immense opportunities for U.S. entrepreneurs. With its growing market, tax incentives, and legal protections, India is an ideal destination for expanding your business. Whether you’re looking for access to government benefits or increased credibility, the advantages of formal registration are clear.

A Private Limited Company offers the best structure for scalability, funding, and long-term growth, making it the top choice for businesses entering India.

Let VJM Global be your trusted partner in handling India’s business domain. We provide expert guidance on company registration, compliance, and tax planning to ensure your business thrives in India.

Reach out to us today and take the first step toward expanding your business.

Registering your business in India opens up access to a huge market, government incentives, and the credibility needed to attract investors and partners.

The process has become much easier with the SPICe+ application, which allows you to register your company online with minimal paperwork and hassle.

Yes, registering your business in India is crucial before starting operations. It ensures legal compliance, protects your personal assets, and provides access to funding, government schemes, and business opportunities unavailable to unregistered entities.

Definitely. Registered businesses, especially startups, can take advantage of tax exemptions and incentives offered under the Indian government’s schemes, such as Startup India.

With online registration, it usually takes just a few weeks to get your company up and running, depending on its structure and documentation.