More U.S. companies are dealing with foreign currencies today. Around one-third of all small- and medium-sized U.S. exporters reported export activities in recent years. That means they face foreign-currency exposure.

When exchange rates shift, the impact goes beyond fluctuating cash. Revenue, costs, and even asset values can swing - sometimes by thousands of dollars. That makes foreign currency accounting critical to get right.

If you treat international invoices like domestic ones, you risk misreporting income, inflating expenses, and complicating tax and audit compliance. Proper FX accounting isn't a bonus. It's a must if you're buying, selling, or operating across borders.

This guide walks you through how foreign currency accounting works and why it's essential for U.S. businesses dealing with global transactions.

Foreign currency accounting exists because exchange rates change constantly. Any U.S. business that invoices, pays, or reports in another currency needs a way to convert those amounts into U.S. dollars accurately.

That's what this framework does: it tells you which currency to use, which rate to apply, and where gains or losses should show up on your financial statements.

Here are the core concepts businesses need before moving into the more advanced rules.

1. Foreign Currency Transaction

A foreign currency transaction happens anytime you:

These transactions must be recorded in USD using a specific exchange rate, which is where most mistakes begin.

2. Functional Currency

Your functional currency is the currency your business primarily operates in - usually USD for U.S. companies. Under ASC 830, every entity must determine its functional currency, because it determines:

For instance, a U.S. software company sells to Europe but pays staff and expenses in USD. Functional currency = USD.

A U.S. subsidiary manufacturing in Mexico, paying wages and suppliers in MXN, may have functional currency = MXN, not USD.

Choosing the wrong functional currency can distort revenue and expenses for the entire year.

3. Reporting Currency

Your reporting currency is the currency you use for financial statements.

For U.S. companies, this is almost always USD, even if a foreign subsidiary operates in a different functional currency.

This is why translation adjustments exist. It bridges the gap between functional currency and reporting currency.

Now that the core terms are clear, the next question is: How does foreign currency accounting actually work in practice?

Foreign currency accounting can look complicated, but it follows a clear logic once you understand the sequence. These are the questions U.S. businesses and CPA firms ask most often and the exact framework GAAP uses to answer them.

Under ASC 830, the functional currency is the currency that best reflects how the business generates and uses cash. It's not based on preference but on economic reality.

You determine functional currency by looking at:

Choosing functional currency incorrectly leads to misstatements in revenue, expenses, and COGS and is a common audit finding for multinational businesses.

But, now, how are foreign currency transactions recorded under GAAP?

Here's the rule CPA firms use daily:

For Example:

You invoice €10,000 at 1.10 USD/EUR → $11,000 revenue.

Customer pays when the rate is 1.08 → $10,800 collected.

That $200 difference is a foreign exchange loss.

This is where most businesses struggle, especially when AR/AP is large or when payment terms are long.

Now, how does consolidation work when subsidiaries operate in different currencies? When a U.S. parent consolidates foreign subsidiaries, GAAP requires:

This is why multi-currency consolidation is one of the most complex areas for CFOs and controllers, and one of the most common reasons companies outsource.

Suggested Read: Understanding US GAAP Consolidation Accounting Rules

When dealing with foreign currency accounting under ASC 830 (U.S. GAAP), many companies confuse two related but very different processes: remeasurement and translation.

The difference matters because each applies under different conditions, uses different exchange rates, and sends gains or losses to other parts of the financial statements.

Here's a breakdown to get it right:

It's important to understand because a multinational with multiple subsidiaries might remeasure some entities, translate others, depending on their functional currencies. Misapplying the wrong method can distort the consolidated balance sheet or income.

Let's understand this with a quick example:

Suppose a U.S. parent owns a subsidiary in Germany. The German entity keeps its books in euros (its functional currency = EUR). At consolidation, the parent needs to present in USD (reporting currency = USD).

If, instead, the German subsidiary had kept its books in USD (not EUR), then each foreign-currency transaction in euros would be remeasured into USD at the transaction date or period-end rate. This would generate FX gains/losses in the income statement each month.

Once you determine the functional currency correctly, you know whether to apply remeasurement or translation. Getting it wrong can misstate your income, assets, and equity.

Also Read: Preparing a GAAP Cash Flow Statement? Outsource from the US to India

Now that the mechanics are clear, how do you handle foreign currency exposure in day-to-day accounting without errors or a messy month-end close?

Foreign currency issues rarely show up during big transactions. They show up in the day-to-day close. These kinds of problems can become a headache when trying to keep monthly reporting clean.

Here are some quick strategies for you to handle your foreign currency in a non-chaotic manner:

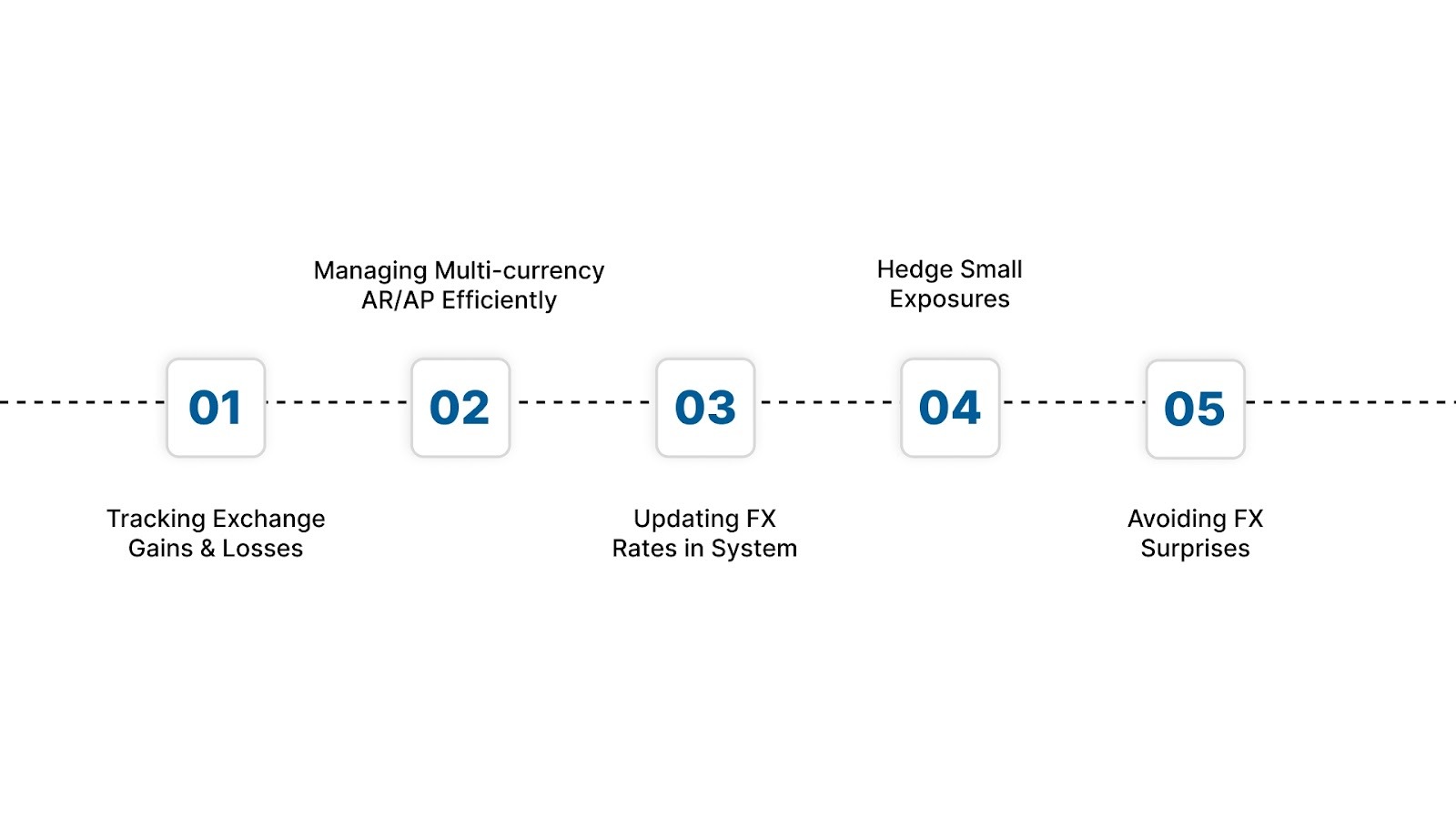

Exchange gains and losses come from one place: changes in the exchange rate between the invoice date and settlement date.

To manage them cleanly:

Many U.S. controllers only review FX at quarter-end, which leads to messy catch-up entries and unpredictable earnings. Month-end revaluation prevents that.

How do you manage multi-currency AR/AP without creating chaos? The biggest exposure usually sits in open receivables and payables. Two rules keep things under control:

AR/AP is where most unexpected FX losses show up, not in bank accounts.

How often should you update FX rates in your system? Well, it depends on transaction volume:

The key is consistency. Using yesterday's rate for some entries and today's rate for others is one of the most common causes of audit adjustments.

Most small businesses don't need derivatives. But you should consider bare hedging if:

Sometimes hedging isn't about speculation. It's about preventing a 2% exchange movement from wiping out a 4% margin.

Now, how do you avoid FX surprises at month-end? Most "FX surprises" come from one of two issues: either a wrong rate applied at the transaction date, or balances not remeasured at the month-end.

A simple workflow reduces month-end headaches:

If foreign currency adjustments routinely delay your month-end close, VJM Global is here to help you. We help U.S. businesses set up clean remeasurement workflows and automated FX processes to keep your close predictable.

Best practices help with daily workflows, but errors still happen. Let's look at the mistakes that cause the biggest reporting and compliance problems.

What happens when foreign currency accounting goes wrong? Well, these mistakes don't stay small. They compound across invoices, subsidiaries, and reporting cycles. They're among the most common issues flagged during audits for international businesses.

Below are the mistakes U.S. businesses make most often, paired with the exact fixes that prevent financial misstatements.

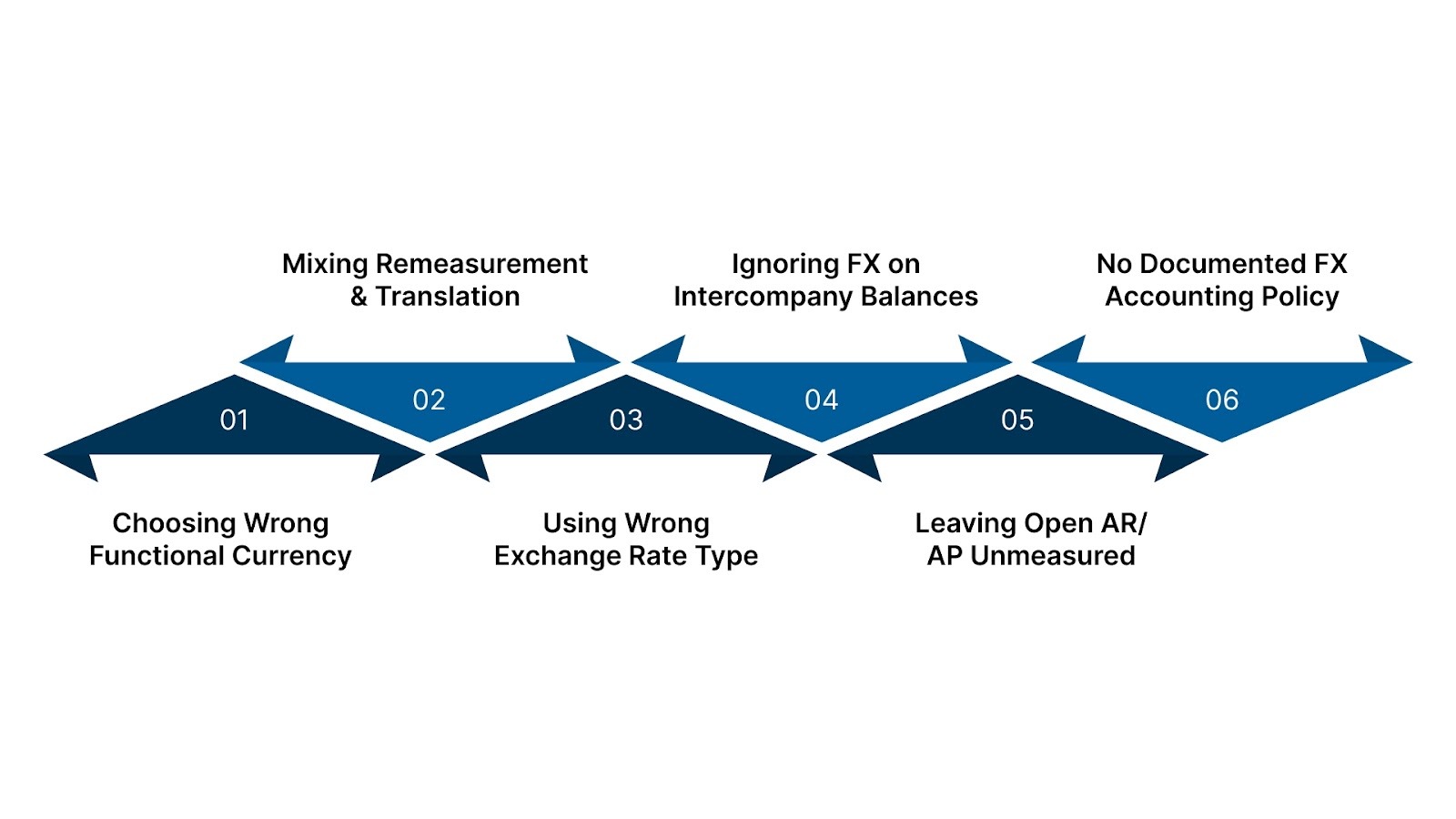

A lot of subsidiaries default to USD when another currency drives their actual cash flows. This single error distorts revenue, expenses, assets, and liabilities for the entire year.

How to avoid it?

Companies often treat remeasurement (functional currency adjustment) and translation (consolidation adjustment) as the same process. They're not. One hits net income; the other hits OCI.

To avoid it, create two separate workflows:

Lock these workflows into your accounting policies so they're never blended.

Teams often apply average rates where GAAP requires spot rates or use outdated rates from prior periods. This is one of the most common causes of FX-related audit adjustments.

To avoid it, use a simple rate map:

Automate rate feeds to eliminate manual errors.

Intercompany loans and payables create quite an FX exposure that explodes at year-end if not remeasured monthly.

How to avoid it?

When receivables and payables sit for weeks without remeasurement, FX gains and losses accumulate without warning. This leads to messy close adjustments.

How to avoid it?

Without a policy, teams apply inconsistent rates, methods, and cutoff practices. This creates audit findings and unpredictable earnings.

To avoid it, write a short, clear ASC 830 policy covering:

Review it annually and train staff on it.

Now that the pitfalls are clear, the next step is choosing systems that prevent these errors automatically.

Foreign currency accounting becomes messy when teams rely on spreadsheets or systems that can't automate rate updates, remeasurement, or multi-currency consolidation. The right tools eliminate most of the errors covered in the previous section.

Below are the tools U.S. companies and CPA firms actually use, along with the specific features that matter for ASC 830 compliance.

Best for: U.S. SMBs handling moderate foreign transactions

Why it works:

However, QuickBooks Online lacks multi-entity consolidation, so groups with foreign subsidiaries need an additional layer.

Best for: U.S. businesses operating in multiple countries

Why it works:

Xero's FX automation is one of the most accurate and consistent features on the market for small to mid-sized firms.

Best for: companies with foreign subsidiaries or multi-entity structures

Why it works:

This is the platform most U.S. mid-market CFOs choose once FX complexity grows.

Best for: manufacturing or distribution businesses with global supply chains

Why it works:

Ideal for companies dealing with foreign suppliers, freight, customs, or multi-country warehouses.

Best for: early-stage U.S. startups expanding internationally

Why it works:

Simple but effective for lighter transaction volumes.

Now, these options are fine, but what features matter most when choosing FX-capable accounting software?

Regardless of the platform, here are the key features that determine whether the system will actually reduce FX errors:

These features prevent the exact functional currency, rate-type, and remeasurement mistakes covered earlier.

With the tools covered, the next step is knowing how to choose the right FX accounting approach for your business.

The suitable approach depends on your transaction volume, exposure, subsidiaries, and reporting requirements. This framework helps U.S. businesses decide which method fits their reality and when to bring in expert support.

There are three rate strategies companies consider. Here's when each one works:

Spot Rate (Transaction-Date Rate)

Use when:

Spot rate is the safest approach under ASC 830 and the only compliant choice for most assets and liabilities.

Monthly Average Rate

Use when:

Average rates cannot be used for assets, liabilities, AR/AP, or intercompany balances. This is where many businesses break GAAP without realizing it.

Forward Contract or Hedged Rate

Use when:

If you hedge, documentation is required. Without it, the accounting gets messy fast.

To decide on that, you should consider a simple self-check. If you answer "yes" to two or more of the following, outsourcing is recommended:

Multi-currency accounting is one of the top outsourcing categories for U.S. CPA firms and mid-market companies because it's where internal teams lose the most time.

If you're unsure which FX method fits your transaction volume, subsidiaries, and GAAP requirements, VJM Global is here to help you figure it out. We help U.S. companies assess risk, build the proper FX accounting framework, and execute it cleanly without slowing down your close.

Foreign currency accounting affects everything from revenue accuracy to cash-flow predictability. With more U.S. businesses buying, selling, and operating across borders, getting ASC 830 right is no longer optional. Clean remeasurement, correct translation, and consistent exchange-rate policies are what keep financial statements reliable and audit-ready.

At VJM Global, we help U.S. companies remove the complexity from multi-currency operations. Here's how we support your cross-border financial workflows:

Partner with VJM Global to build a foreign currency accounting framework that's accurate, compliant, and built to scale with your global operations. Contact us today to simplify how your business handles international financials.

You assess the currency that drives the subsidiary's cash flows - sales, labor, materials, financing, and pricing decisions. Under ASC 830, the currency with the most substantial economic influence becomes the functional currency, not the parent company's preferred currency.

Use the spot rate on the transaction date. For recurring revenue or expenses, an average rate may be acceptable if it reasonably approximates daily rates. Monetary items like AR/AP must be revalued at the period-end rate.

Unrealized gains/losses arise when AR, AP, loans, or foreign bank balances are remeasured at month-end using the updated exchange rate. ASC 830 requires this revaluation even before payment occurs.

Translation converts a foreign entity's functional-currency financials into the parent's reporting currency. Rate changes create a translation adjustment, which appears in Other Comprehensive Income (OCI), not in net income, until the foreign entity is sold or liquidated.

Use a system with automated exchange-rate feeds, apply consistent rate rules, remeasure monetary items monthly, and document your ASC 830 policy. Most small-business FX errors come from manual entries or inconsistent rate usage.