%20(21).webp)

Managing your startup's financial operations demands significant time and specialized expertise. Building an in-house accounting team involves substantial recruitment and salary costs.

This administrative burden can divert your focus from core product development and growth. Outsourcing your accounting to a specialized offshore firm in India provides a strategic solution. You gain access to a skilled team proficient in US GAAP and cloud accounting software.

This model delivers high-quality financial management while significantly reducing operational expenses. This guide explores the key advantages of outsourcing accounting for your US startup.

You will learn how it enhances financial control, improves reporting, and supports scalable growth. We will outline how this approach provides cost efficiency and strengthens your financial foundation.

Outsourced accounting involves hiring an external firm to manage your startup's financial operations. This includes bookkeeping, financial reporting, tax preparation, and compliance.

For US startups, it ensures adherence to GAAP standards and IRS regulations without maintaining an in-house team. You gain access to expert accountants and advanced technology while converting fixed salary costs into variable operational expenses.

This model provides professional financial management tailored to your growth stage, allowing founders to focus on core business development.

Also read: Effective Strategies for Accounts Payable Management

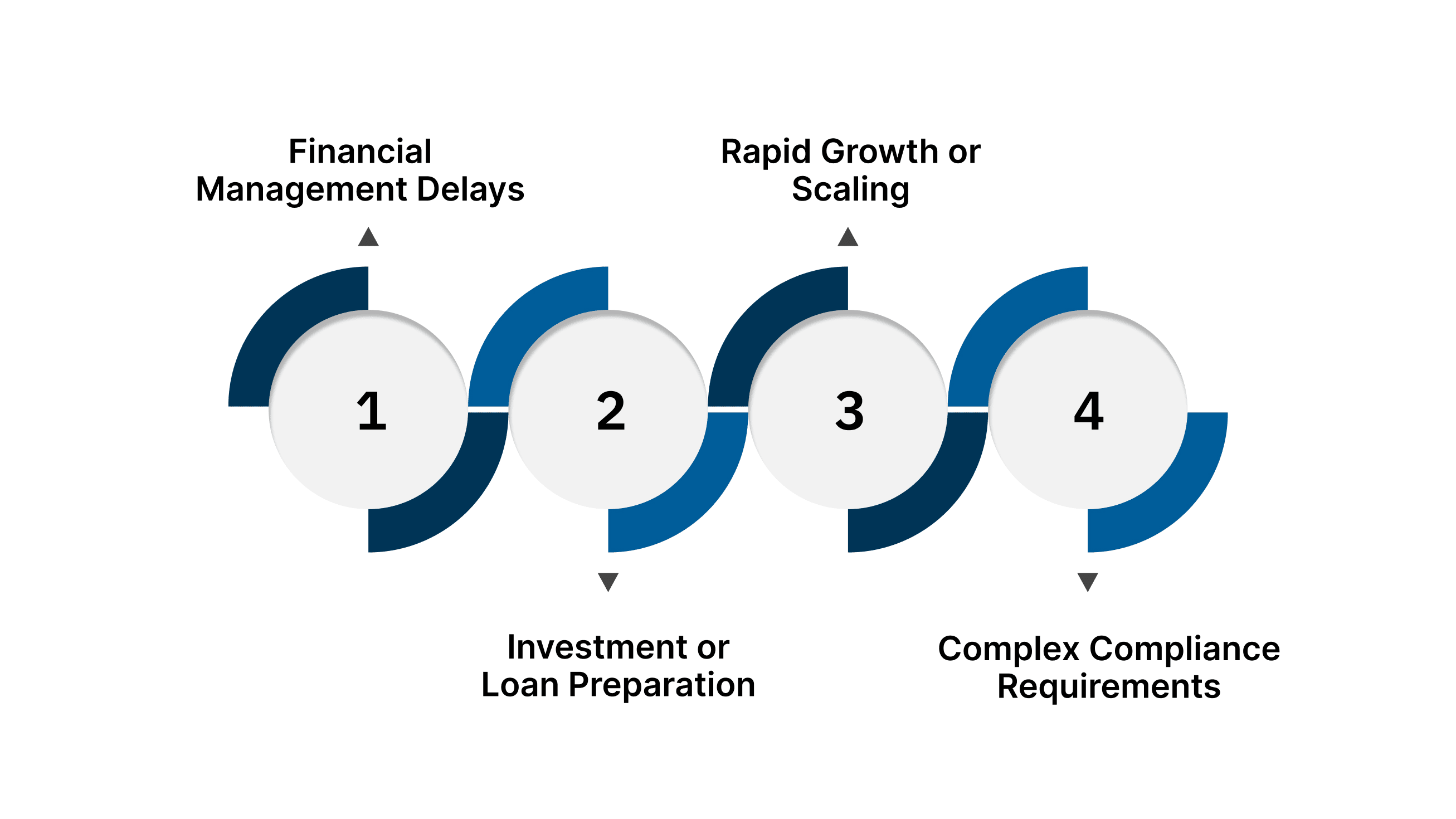

Knowing what accounting entails helps identify when you need support. Recognizing these specific triggers allows for timely and effective intervention.

Identifying the right moment to seek professional accounting support is crucial for US startups. This decision directly impacts your operational efficiency and financial control.

Proactive engagement prevents minor bookkeeping issues from becoming major financial reporting problems.

Timely implementation supports 409A compliance and prepares you for investor due diligence. Here’s when you should consider an accounting service:

Your founding team spends excessive hours on basic bookkeeping and reconciliation tasks. This diverts crucial focus from product development and customer acquisition strategies.

Monthly close procedures become delayed, or financial statements lack consistency. These operational inefficiencies signal the need for dedicated accounting expertise.

Series A investors require GAAP-compliant financial statements and clear cap table management. Your records must demonstrate proper revenue recognition and expense classification under ASC 606.

Organized books build credibility during intensive due diligence processes. Proper accounting makes your startup more attractive to sophisticated capital sources.

Rising customer acquisition and expanding transaction volumes overwhelm manual processes. You need systems that automate accounts payable and receivable management.

Financial reporting must scale with your expanding multi-state operations. This inflection point demands professional financial infrastructure and controls.

Sales tax nexus requirements and state income tax obligations create complex compliance layers. Employee classifications and equity compensation require expert handling to avoid penalties.

Missing quarterly estimated tax payments or payroll filings triggers IRS penalties. Professional guidance ensures compliance across federal and state jurisdictions.

External auditors require supporting documentation and clear transaction trails. Your startup needs proper internal controls over financial reporting (ICFR).

Board members and investors expect timely, accurate financial packages. Professional accounting ensures you meet all SEC reporting requirements when needed.

Identify your startup's unique accounting requirements. Reach out to VJM Global to discuss your options. We manage everything from bookkeeping to audit preparation.

Also read: How Much Does a CPA Charge for Tax Preparation

Once you decide to seek help, you must evaluate the available models. Different outsourcing structures suit various startup stages and needs.

US startups typically choose from three primary outsourcing models for their accounting needs. Each model offers distinct advantages for different stages and operational requirements.

Your selection should align with your company's current size and financial complexity. Understanding these options helps you make an informed strategic decision.

You receive a full team dedicated solely to your company's accounting functions. This model provides comprehensive coverage for all financial operations. The team integrates deeply with your US-based management and processes. This approach suits startups with complex, high-volume transaction needs.

Key consideration:

You engage providers for specific accounting projects or periodic tasks. This includes quarterly closes, audit preparation, or system implementation. The arrangement has a defined scope, timeline, and deliverables. This flexibility suits early-stage startups with fluctuating accounting needs.

Key consideration:

You partner with firms offering complete accounting department services. They handle everything from bookkeeping to financial reporting and compliance. The provider manages the team and ensures US GAAP adherence. This comprehensive solution supports startups seeking turnkey financial operations.

Key consideration:

Understanding the models highlights the strategic value of specific locations. India offers distinct advantages that benefit US startups directly.

India has become the preferred destination for accounting outsourcing among international startups. Several strategic advantages make it particularly suitable for US-based technology companies.

These benefits extend beyond simple cost reduction to operational excellence. Understanding these factors helps you evaluate this strategic decision properly.

You can reduce accounting costs by forty to sixty percent compared to US rates. This includes savings on salaries, benefits, and operational overhead expenses.

The cost structure allows you to access premium talent within budget constraints. These savings can be redirected to core business functions.

Indian professionals typically hold CA, CPA, or equivalent accounting qualifications. They maintain current knowledge of IFRS and US GAAP reporting standards.

Many accountants have experience serving global technology startups specifically. This expertise ensures compliance with international financial regulations.

The time difference enables overnight processing of US daytime transactions. Your accounting team works while your US office is closed for business.

This creates a follow-the-sun model for financial operations. Daily reports are ready when your management team arrives each morning.

Indian accounting firms utilize current cloud-based accounting platforms extensively. They maintain proficiency with international systems.

Most providers implement strong automation and AI tools for efficiency. This ensures compatibility with your existing technology infrastructure.

Accounting professionals demonstrate excellent English communication skills consistently. This facilitates clear reporting and seamless collaboration with US teams.

Documentation and financial statements meet international language standards. Communication barriers are minimal in professional accounting contexts.

Selecting the right accounting partner requires careful evaluation of several critical factors. The ideal provider should align with your startup's specific stage and industry requirements.

This due diligence ensures a productive long-term partnership and service quality. Consider these essential criteria during your selection process.

The provider should demonstrate experience with early-stage US companies and their specific needs. They must understand cap table management and investor reporting requirements.

Ask for references from companies at similar funding stages and industries. This knowledge directly impacts the quality of your financial operations.

Verification method:

VJM Global’s team possesses the specific expertise outlined above, with a proven track record supporting US startups. Our professionals ensure your financial operations meet investor standards and drive strategic growth. Get started today.

The provider should use modern, cloud-based accounting platforms common in the US market. Their systems must integrate with your payment processors and expense management tools.

They should offer automated reconciliation and real-time financial reporting features. This technical compatibility ensures efficient workflow and data accuracy.

Verification method:

The provider must have comprehensive information security policies meeting US standards. They should maintain SOC compliance and follow data protection regulations.

Request documentation of their security certifications and audit procedures. This protects your sensitive financial information and ensures regulatory compliance.

Verification method:

The provider should accommodate your changing service needs as you secure funding. Their model must support rapid scaling during growth phases and funding rounds.

Discuss their capacity planning for handling increased transaction volumes. This ensures they can support your business through different growth stages.

Verification method:

The provider must establish clear communication channels within US business hours. You should receive regular financial packages, including burn rate analysis.

Ensure their team can provide timely support for investor inquiries. This transparency maintains alignment with your board and investors.

Verification method:

Also read: Settle Tax Debt with Confidence: Relief Options For US Businesses

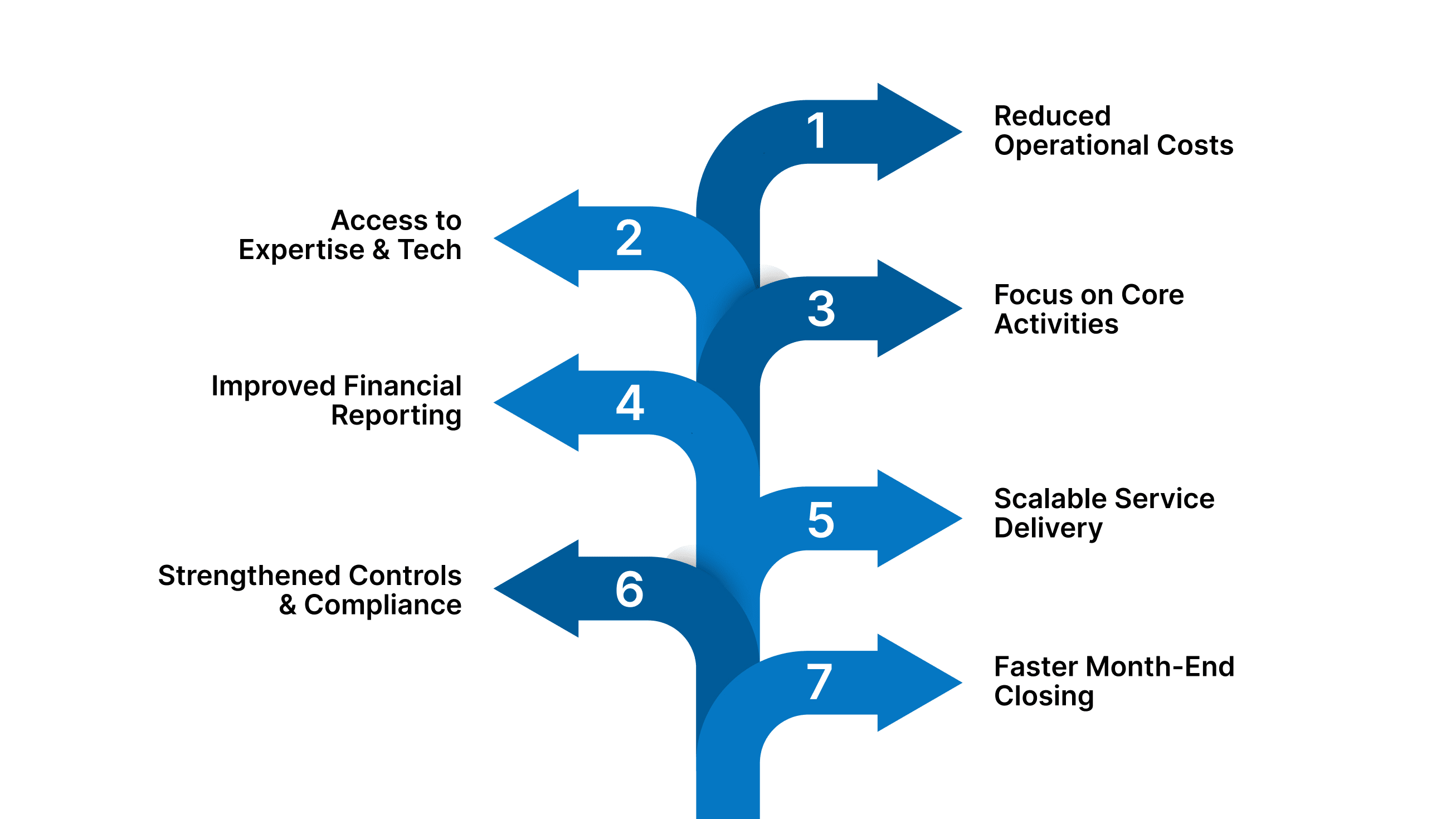

Understanding the selection criteria frames the significant benefits available. These advantages demonstrate the strategic value of a well-chosen partnership.

Outsourcing delivers critical financial management capabilities that support sustainable startup growth. These benefits extend beyond simple cost savings to strategic operational advantages.

They provide access to expertise typically unavailable to early-stage companies. This approach transforms accounting from an administrative task into a strategic asset.

You avoid the substantial expense of hiring a full-time, in-house accountant or controller. This includes salary, benefits, payroll taxes, and training costs for US positions.

There are no costs for some accounting software licenses. You convert these fixed expenses into a predictable monthly service fee.

How it helps:

You gain immediate access to professionals skilled in US GAAP and tax compliance. These experts maintain current knowledge of IRS regulations and multi-state tax requirements.

They utilize advanced, cloud-based accounting platforms common in US markets. This provides enterprise-level financial infrastructure from day one.

How it helps:

Your founding team can dedicate maximum time to product and market development. You eliminate distractions related to bookkeeping and financial administration.

This clarity improves decision-making speed and operational efficiency. It allows you to concentrate on revenue-generating activities and fundraising.

How it helps:

You receive accurate, timely financial statements prepared to US standards. These reports include burn rate analysis and key SaaS metrics for investors.

Your provider can create custom reports for Series A due diligence requirements. This data supports informed strategic planning and budgeting decisions.

How it helps:

The service level can be adjusted quickly to match your funding stage growth. You can increase support during 409A valuations or audit periods easily.

There is no need for lengthy recruitment or training processes. This creates a truly flexible financial operation that grows with you.

Professional firms implement robust processes for financial transactions and approvals. They establish proper segregation of duties following SOX-like controls.

Your accounts undergo regular reconciliation and validation checks. This creates a strong foundation for future audits and due diligence.

How it helps:

Experienced teams can complete your monthly close and reporting efficiently. They follow standardized processes and checklists for US financial reporting.

This provides you with timely financial information for decision-making. You avoid the delays common with inexperienced bookkeepers.

How it helps:

While the benefits are substantial, you must also consider potential hurdles. Proactively managing these challenges ensures a smooth and successful engagement.

Also read: How to Establish a Shared Services Center Setup in India from the USA

While outsourcing offers significant benefits, US startups should consider several implementation challenges. Understanding these issues helps you select the right provider and establish effective processes for your operations.

Proactive management of these areas ensures compliance with IRS regulations and US accounting standards. This foresight protects your financial operations and investor relationships.

You must share sensitive financial data including investor details and cap table information. Ensure the provider understands US data protection laws and SEC requirements.

They should maintain SOC 2 compliance and implement robust encryption protocols. Regular security audits are essential for protecting stakeholder information.

Risk mitigation strategy:

Communication gaps can disrupt critical financial reporting and closing cycles. Time zone differences may delay responses to urgent investor inquiries.

You need established processes for quarterly closes and board reporting. Clear escalation procedures ensure timely resolution of compliance issues.

Risk mitigation strategy:

You relinquish direct control over accounting treatments and revenue recognition. The provider must consistently apply ASC 606 and other US standards.

Establishing clear benchmarks for financial statement quality is crucial. Regular reviews ensure compliance with US audit requirements.

Risk mitigation strategy:

Transitioning accounting functions requires careful planning for US compliance. You must transfer historical data supporting tax positions and deductions.

The provider needs an understanding of your state and local tax obligations. Proper documentation ensures smooth audit trails for US authorities.

Risk mitigation strategy:

Navigating these challenges requires a provider with specific expertise. VJM Global is structured to address these exact concerns for startups.

Also read: How to Start a Clothing Brand in India from the US: A Step-by-Step Guide

Managing accounting in-house often means high payroll costs and software expenses. Finding qualified staff with expertise in US GAAP and startup financial dynamics adds another layer of complexity. These challenges can drain your resources and distract from core business growth.

VJM Global provides specialized accounting outsourcing designed specifically for startups. Our team's deep knowledge of US GAAP ensures your financial reporting meets all required standards. We handle your accounting needs with precision while you focus on scaling your business.

Our service includes several key features:

Partnering with VJM Global provides your startup with professional financial management designed for growth.

Outsourced accounting provides significant strategic advantages for startup financial management. It offers cost efficiency, expert knowledge, and valuable operational flexibility. Understanding implementation challenges and selection criteria ensures a successful partnership.

This approach supports sustainable growth and investor readiness. VJM Global specializes in accounting services designed specifically for startup requirements. Our team delivers accurate financial reporting and compliance management. We provide the strategic insight your growing company needs.

Our approach supports your business objectives effectively. Contact VJM Global today to discuss your startup accounting requirements.

Startups commonly outsource bookkeeping, financial statement preparation, and tax compliance. Many also benefit from outsourced controller services and financial analysis from a specialized provider like VJM Global. Cash flow management and investor reporting are other frequently outsourced functions. This allows founders to focus on business development.

Costs vary based on transaction volume and service complexity, but are typically 30-50% less than hiring in-house. Most providers offer tiered pricing starting from basic bookkeeping packages. Additional services like financial analysis or tax planning may involve extra fees. Many firms provide customized quotes based on specific needs.

Reputable providers should have SOC compliance certifications and data encryption protocols. They must use secure cloud platforms with multi-factor authentication. Clear data handling policies and confidentiality agreements are essential. Regular security audits and employee background checks demonstrate a commitment to protection.

Establish regular meeting schedules and clear response time expectations from the beginning. Use collaborative cloud platforms for document sharing and task management. Designate primary contacts on both teams to streamline communication. Regular performance reviews help maintain alignment on goals and expectations.

Consider transitioning when accounting costs exceed what a full-time hire would cost. This typically occurs at later funding stages or with significant revenue growth. Complex, industry-specific accounting needs might also justify internal hires. The transition should be planned carefully with your outsourcing provider.